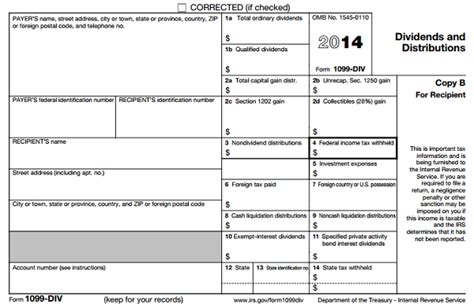

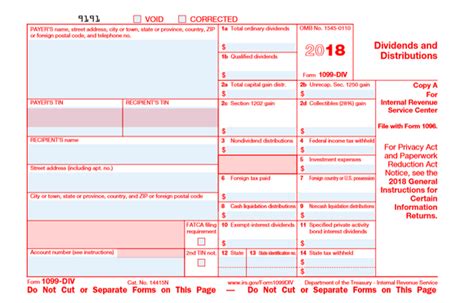

where do i enter capital gains distributions box 2a The instructions to Form 1099-DIV explain that they are included in your capital gain distributions on Line 13: Box 2a. Shows total capital gain distributions from a regulated investment .

$26.99

0 · form 1099 div box 2a

1 · form 1099 div box 12

2 · capital gain distributions tax treatment

3 · box 2a 1099 div

4 · box 12 exempt interest dividends

5 · are capital gains distributions taxable

6 · 1099 div box 12 states

7 · 1099 div 2a explained

This document provides information on the principles and techniques for fabricating wax patterns for crowns and fixed dental prostheses using the lost wax technique. It discusses the prerequisites for wax patterns including correcting defects on dies, providing cement space, and marking margins.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

brackets damon metalicos

Consider capital gain distributions as long-term capital gains no matter how long .The profit paid out is a capital gain distribution. This also applies to pay outs made by crediting your cash account. File with H&R Block to get your max refund. File online. File with a tax pro. . The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13. View solution in original post

form 1099 div box 2a

Form 1099-DIV data entry. To enter Form 1099-DIV, Dividends and Distributions, you can either: Use Source Data Entry. Use the following table to find where to enter the information. note. To .The instructions to Form 1099-DIV explain that they are included in your capital gain distributions on Line 13: Box 2a. Shows total capital gain distributions from a regulated investment .

Consider capital gain distributions as long-term capital gains no matter how long you've owned shares in the mutual fund. Report the amount shown in box 2a of Form 1099-DIV on line 13 of Schedule D (Form 1040), .Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box 2e and box 2f. For further information, see Section 897 gain, . Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital gains and losses from. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for a profit. These are considered long-term capital gains .

form 1099 div box 12

capital gain distributions tax treatment

Box 3 is used to report the portion of the amount shown in box 2a that is reportable as capital gains. With a zero in box 3, it indicates that the entire taxable amount in box 2a is taxable as ordinary income. June 5, 2019 10:19 PM. 0 4 . No. Enter box 3 as shown on the Form 1099-R provided by the payer. .

Filing a 1099-div. S Corp dissolving, report the total liquidation dist. amount on line 9, do I figure the stock basis and enter the capital gain amount on line 2a also? Announcements Do you have a TurboTax Online account?

Enter any portion of your capital gains that came from U.S. obligations." It then lists my total capital gains (total of box 2a, total capital gain distribution, for all funds). Then there is a single box for entering "Total From U.S. Obligations." On my T. Rowe Price 1099-DIV, there is a table which lists interest on direct U.S. government .

Customer: Hello Pearl, yes where do I enter Box 2a total Capital Gain distribution on and 1041 form? Thanks Accountant's Assistant: The Accountant will know how to help. Please tell me more, so we can help you best. Customer: I need to file a 1041 for my mother-in-law and on her 1099-DIV it has box 2a with a number in it - but I don't see where I should place this number on the . It depends. If you are a United States Citizen you do not need to complete that box. The IRS Instructions for Form 1099-DIV show the following information (page 3). 'Section 897 gain.If a regulated investment company (RIC) described in section 897(h)(4) (A)(ii) or a real estate investment trust (REIT) disposes of a United States Real Property Interest (USRPI) at a gain, . Answered: WHERE DO I ENTER 1099 DIV WITH BOX 1A, 1B, 2A, 3 & 5 IN S CORP I have S Corp client who has about seven 1099-DIV with above box filled in. Welcome back! Ask questions, get answers, and join our large community of tax professionals. . As to the Nondividend distributions, and the Section 199a dividends..I haven't a clue. @Xarax --. I think you are mixing up two different things. A capital gain (or loss) occurs when you sell your mutual fund shares. These sales are reported on a 1099-B. A capital gain distribution occurs when the mutual fund sells its own shares of stocks or other investments internally, within its own portfolio.If the mutual fund has capital gains from these transactions, .

Line 13 of Schedule D is for capital gain distributions which can be entered in the Interest and Dividends section of the program (select Dividends on 1099-DIV and then enter your capital gain distributions in Box 2a). Capital gains distributions that are reported in box 2a of Form 1099-DIV are transferred to Schedule D line 13. TurboTax will do this automatically. All you need to do is to enter the information from Form 1099-DIV.

The form 1099-DIV only reports the liquidating distribution(s) in the applicable box (9 or 10) . do I figure the stock basis and enter the capital gain amount on line 2a also? Thanks - that fixed it. March 16, 2024 7:16 PM. 0 765 Reply. Bookmark Icon. Still have questions? Make a post. Featured forums. Taxes. Lower Debt. Investing. Self . Your mutual fund administrator should send you a tax form. To enter form 1099-DIV, see Where do I enter my 1099-DIV in TurboTax Online?. When your mutual fund makes a distribution of its investment earnings to you and reports it in box 2a of Form 1099-DIV, the IRS generally allows you to treat the distribution like a long-term capital gain.

It depends. If you are a United States Citizen you do not need to complete that box. The IRS Instructions for Form 1099-DIV show the following information (page 3). 'Section 897 gain.If a regulated investment company (RIC) described in section 897(h)(4) (A)(ii) or a real estate investment trust (REIT) disposes of a United States Real Property Interest (USRPI) at a gain, . But even Online Deluxe can handle capital gains distributions reported on a 1099-DIV, Box 2a. So even if you were using Online TurboTax, you would not have to upgrade from Deluxe to Premier solely for capital gains distributions on a 1099-DIV. You do not enter them anywhere. They are already included in box 1 of the 1099-Div. So, they are taxed as dividends and do not go on Schedule D. Note that short-term capital gain distributions are shown in an un-numbered box, on form 1099-DIV, between boxes 1b & 2a. There is no entry point, for that, on the 1099_DIV screen, in TurboTax.

Box 2a. Shows total capital gain distributions from a regulated investment company (RIC) or a real estate investment trust (REIT). See How To Report in the instructions for Schedule D (Form 1040). But, if no amount is shown in boxes 2c-2d and your only capital gains and losses are capital gain distributions, you may be able to report the .

box 2a 1099 div

The next step asks "Any foreign source qualified dividends or long term capital gains?" It includes the foreign income that I entered in the previous step (based only on the dividend income). Are "long term capital gains" in this question the same as capital gains distributions from box 2a on the 1099-DIVs? Capital Gain Distributions: What Investors Need to Know. Capital gain distributions, reported in Box 2a, are payments made by mutual funds or REITs from profits earned on the sale of securities. These distributions are .Additional Capital Gain Distributions - Enter on this line capital gain distributions that aren't entered elsewhere in the return, e.g., on a 1099-DIV. There are two entries possible: . - Schedule D isn't required when the only capital gain distribution reported is on 1099-DIV box 2a, and boxes 2b, 2c, and 2d are zero. Q. Can I offset capital gains distributions (CGD) from a mutual fund (box 2a on form 1099-DIV), with long-term losses from selling stocks? A. Yes. This happens automatically, in TurboTax (TT), on Schedule D, after you enter your 1099-DIV and your stock sales. TT will also apply any short term losses, from stocks, against the CGD, if needed.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI .

To address your specific question: The form 1099-DIV only reports the liquidating distribution(s) in the applicable box (9 or 10) Stock basis should be maintained by the respective shareholder The shareholder will then report both pieces of information on their 1040 form 8949 Selling Price = liqui. Where do I enter a capital gains distribution Box 2a. Where do I enter a Non Dividend Distribution 1099 Div (Box 3) Where do I enter Foreign Tax Paid (1099B Box 7) February 22, 2020 5:48 AM. . Box 2a for "Capital Gain distributions" is located under the Box 1a, Total Ordinary Dividends. (See screen shot below) A capital gains distribution reported in box 2a of Form 1099-DIV represents your share of capital gains that are a result of the mutual fund selling some of its holdings for a gain. The capital gains distribution is taxable to you even if you never sold anything or received any actual income from the mutual fund.

Box 2d contains amounts included in Box 2a attributable to the 28% capital gains rate from the sales or exchanges of collectibles. If there is an amount here, you may need to complete IRS Form 8949. Additionally, you may need to complete the 28% gains rate worksheet located in the Schedule D instructions to determine the amount you’ll enter . The form 1099-DIV from Prudential has no box 2a. What do I enter in your box 2a blank? US En . United States (English) United States (Spanish) Canada (English) Canada (French . My guess is that you had no short term capital gains distributions, (typically from mutual funds), and you could confirm that by looking at your own statements sent to .Search results. All Articles Community. Filter (1) All Reset All Reset Exception 2. You must file Schedule D (Form 1040), but generally do not have to file Form 8949, if Exception 1 does not apply and your only capital gains and losses are: •Capital gain distributions; •A capital loss carryover; •A gain from Form 2439 or 6252 or Part I of Form 4797; •A gain or loss from Form 4684, 6781, or 8824;

box 12 exempt interest dividends

Best Buy Metals offers corrugated metal siding, Classic wavy corrugated steel sheets suitable for both contemporary modern and rugged exteriors.

where do i enter capital gains distributions box 2a|1099 div box 12 states