what box should a partner distribution appear on a k-1 Regulations section 1.705-1(a)(1) provides that a partner is required to determine the adjusted basis of its interest in a partnership when necessary to determine its tax liability or that of any other person. CNC Wire Cut Machine refers to a CNC Wire Cut EDM machine that uses continuous moving fine metal wire as an electrode, on the workpiece pulse spark discharge to remove the metal, cutting and forming. Early CNC Wire Cut Machine used electric model-tracking to control the cutting path.

0 · schedule k 1 dividend identification

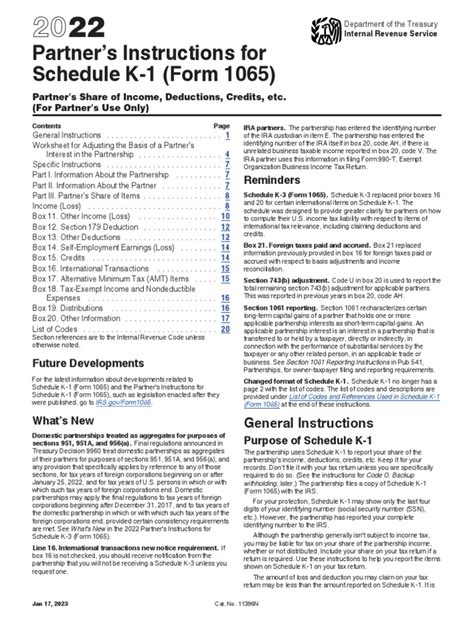

1 · partner's instructions for schedule k 1

2 · k1 and not w2

3 · k1 1065 box 19

4 · k 1 form 1040

5 · k 1 1065 distribution

6 · excess distributions in k1

7 · box 19 of k 1

When it comes to wiring and installation of electrical components, connecting a Bx cable junction box is an essential part of the process. This specialized box is used to connect several lengths of Bx electrical cables together, creating a safe and secure electrical network.

schedule k 1 dividend identification

Regulations section 1.705-1(a)(1) provides that a partner is required to determine the adjusted basis of its interest in a partnership when necessary to determine its tax liability or that of any other person.The amounts reported on these lines include only the gross income (code D) .

house double metal door

Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of property. Think of a . For these to appear on line 28 of Form 1040, your Schedule K-1 must show with code R in box 13 the total amount of contributions made through the partnership and with code . Distributions are shown, in box 19 and definately NOT in 9a. View solution in original post. Answered: Taxpayer took distributions in excess of his basis from his .

Take a look at what you should know about the Schedule K-1 tax form and to understand how taxation works for partners both when the distribution does and doesn't exceed the partner's basis. The allocation of tax items on Schedule K-1 represents a partner's share of partnership income, whether distributed or not. For example, if a partnership has 0,000 of taxable income but only distributes ,000 to .

There can be an amount reported in Box 1 (Ordinary business income/loss) and that amount can be passive. There can be an amount reported in Box 2 (Net rental real estate .What is Schedule K-1? Schedule K-1 is a schedule of IRS Form 1065, U.S. Return of Partnership Income. It’s provided to partners in a business partnership to report their share of a partnership’s profits, losses, deductions and credits to the IRS.Partnerships should use Schedule K-1 tax forms to distinguish partnership income from owners' income. By doing this, your business will more likely avoid the ,171 tax penalties the .

The purpose of Schedule K-1 is to report each partner’s share of the partnership’s earnings, losses, deductions, and credits. Schedule K-1 serves a similar purpose as Form 1099. I have entered the partner information on the Business Info tab, under Partner/Member information. All members have initial capital and some of the members have distributions that should show in Partner’s Capital Account Analysis section of the K-1 form.Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. . Schedule K-1 may show only the last four digits of your identifying number (social security number (SSN), etc I am part of a four-member partnership - with equal shares (25%) of ownership. This year (2018), one of the partners left and was immediately replaced by a new member. We decided to pay the leaving member 25% of the equity in the business at the time of his departure (based on the balance sheet as of his last date of participation).

How should that payment be .

I am closing an LLC and preparing final 1065 and K-1s. One partner has tax basis ending capital amount of 00. The other members have The beneficiary that all the DNI is reported on the K-1 is 100 years old. The son is the trustee who is responsible for the filings. I have not seen the Trust documents nor spoken to the attorney. When I asked it was discouraged. The Irrevocable Trust was set up at the time the wife of the K-1 beneficiary.. If there is exactly 00 cash available, does the LLC pay that member 00, record it as a withdrawal in his K-1 part L (bringing his final capital to So if your K-1 has 3 entities that make up the numbers in box 20 (owns three other partnerships) and each one of this reported separately on Statement A, you would wind up with a total of 4 K-1's with the name of the original K-1 partner and three that contain the QBI information with the EIN's of those three partnership and the associated QBI information.), and box 19 as a distribution? If the answer is yes, does the LLC need to issue a 1099 div . Contributions in this manner are to be reported on Schedule K-1 (Form 1065), and are not included in the partner’s net earnings from self-employment under Section 1402(a) so if your partnership handled the 1065 reporting correctly, then on your 1040 you take the deduction for the 00 reporting them as personal (not employer) contributions. Partners taxed on k for 2022 but can label a Distribution on the K-1 box 19 with code A for 0k each (0k end of year profit). @Critter-3 has the best answer with a link explaining Line 19 on the K-1 Liabilities that become part of your tax basis will vary depending on whether you are a limited partner / member, general partner, and if the K-1 is completed correctly, should be reflected in Section K of the K-1. This is a complicated area that is misunderstood by many.

There are various other amounts regarding income and losses on the K-1, but they don't appear significant enough to make up the difference between the 4k and 7k. . (from Schedule K-1, Box 9a) - makes no sense. ,910 (from non-related investments) . except for the final K-1 liquidating distribution. The partner's distributive share . The distribution is long term capital gain by the amount that exceeds your partnership basis.Therefore, only the amount of box 19 A that is greater than your adjusted basis in the partnership will be taxed.. It sounds like your capital basis is showing you there was no excess gain.Any excess long term capital gain should be reported in the capital gain boxes (or . How to manually track K-1 distributions. There's no specific input for K-1 distributions in the partnership and fiduciary modules. Lacerte also doesn't can't track basis or at-risk limitations of Passthrough K-1s in the fiduciary module. So, the basis—including Line 19, Distributions—should be tracked manually on Screen 51, Notes.

My K-1 shows a distribution but the Parntership did not distribute any money this past year. Why do i have to pay taxes on it? I am a small minority owner and have no say in whether to distribute or not. Seems unfair to have to pay on money I have not recvd.Distribution in excess of partner basis in Schedules K-1 IRC section 705 states that partner basis can't be decreased below zero. When distributions or decreases in the partner's share of partnership liabilities would decrease the basis below zero, a . Your borrower showed ,000 on 1065 K-1 Box L Withdrawals and Distributions and only ,500 on Line 19 with a code of A. . if the partner is an individual, you should see a 1040 Schedule D entry for the capital gains. If .Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. . Schedule K-1 may show only the last four digits of your identifying number (social security number (SSN), etc

It is not reported on your tax return but on a 990-T form. (The custodian of your IRA is required to file the form for you but you must submit the K-1 form(s) to them - ask the custodian about this). Unrelated Business Income is reported as .Box 19. Distributions. For 2023, partners receiving distributions of property from a partnership in a liquidating or non-liquidating distribution under certain circumstances must attach a statement to their tax return. See Box 19. . Schedule K-1 may show only the last four digits of your identifying number (social security number (SSN), etc I've received my K-3 for input. I've read several entries about the K-3. I'm settled how to enter it. My question is for Part II, Section 1 Income and Section 2 Deductions, column (f) Sourced by partner. My form only shows U.S. source. There is nothing entered in the Foreign Source columns (b-e). Ho. This is especially true when there are amounts or information entered in Box 20 of the K-1. . It will show an individual partner’s share of the partnership’s income and losses. It’s extremely important to remember that the passive activity rules are applied per partner and to the entire activity. The partnership can report a large .

The IRS is going to tax the earnings, though, and when the earnings are shown on the K-1, the recipient gets taxed. What type of entity (LLC, Trust, etc) is giving you the K-1? For a partnership (LLC), the income has to get passed through and the tax paid by the K-1 recipient whether they received any income or not. Making the switch from employee to business owner requires some getting used to. One of those adjustments is understanding the difference between the income reported on a K-1 and the amount of cash distributions received. .

I'm trying to teach myself some basics of taxes and returns, so I can do them myself next year. My wife owns a small LLC (S corp), which her accountant did taxes for last year (and will this year too). While going through them, on the Schedule K line 6d is Owners Distribution (also listed again on the K-1). Is this the same as what she took in pay from the . I personally would never rely on Sch L from a K-1 to calculate gain/loss on a liquidating distribution. At least half the people preparing K-1s have no idea what they are doing. You need to round up all the old K-1s and recalculate your correct ending outside basis. Only then will you know how to calculate gain/loss on the 6,040 check.

The W-2 shows earnings you received by paycheck as an employee, which should have had payroll taxes deducted and sent in by the company. The K-1 shows your share of the partnership's income or loss that is yours because you are a partner. You may or may not have received some of this as a cash distribution, but it is still income to you. Each year there was a new loan and a big distribution on the K-1, but effectively larger cash flow deficits on a global level as more leverage was taken on by the sponsor. I had to explain to the lender that even though her K-1 cash flow looked great, the loan was substandard because the actual global cash flow had gotten very bad. Therefore, accurate and timely filing of Form K-1 is essential for both beneficiaries and partnerships/trusts to avoid penalties and ensure compliance with the law. Completing and Filing Form K-1. Form K-1 is a crucial document that taxpayers must complete and file when they have income from a trust or an estate.

partner's instructions for schedule k 1

k1 and not w2

house metal frame

k1 1065 box 19

Therefore, this article will tackle the manufacturing process of safes, the materials used and essentially, the components that make up a safe. Let’s get to it! What Types of Steel are Used for Safe 1. Carbon Steel

what box should a partner distribution appear on a k-1|box 19 of k 1